You might want to retire early or simply be able to go on a family vacation every year. Maybe you want to leave the paycheck-to-paycheck cycle behind. What was that event, and what about it motivated you to your money right? Odds are there was a defining event that led you to sit down and make a budget. Identify your household’s budgeting goalsīefore you get started with your family’s household budget, it can be helpful to sit down and identify your goals.

#Household budget example free#

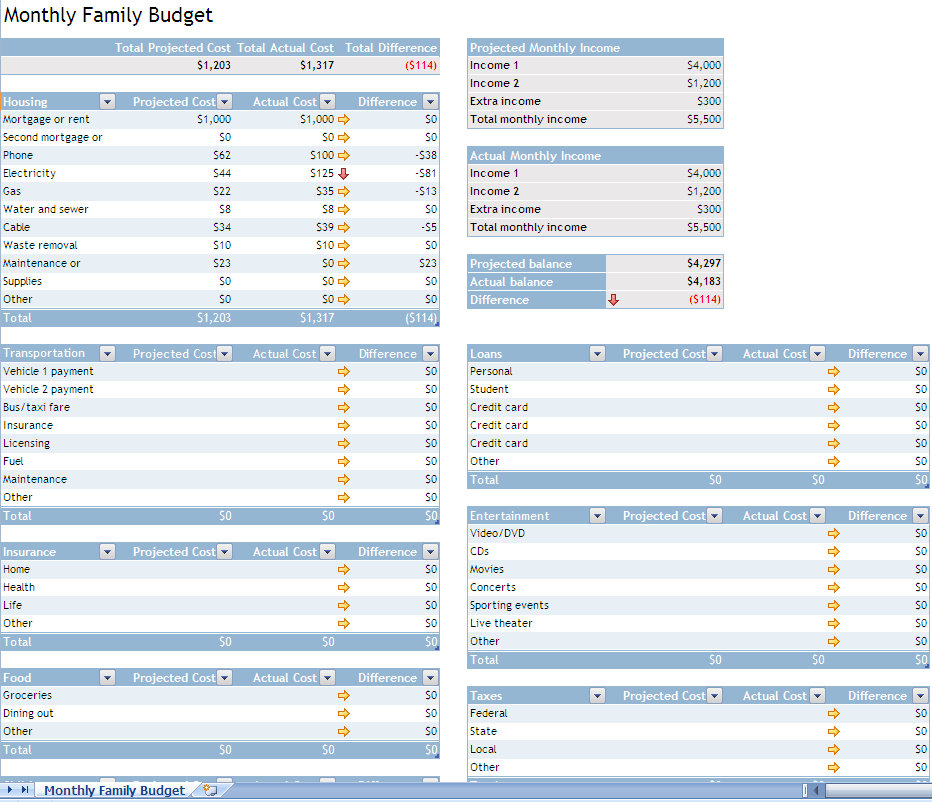

Try this free household budget spreadsheet template.Identify your household’s budgeting goals.Wonder no more! Here are the steps you’ll need to follow to build your monthly budget, along with an easy and absolutely free household budget spreadsheet.

#Household budget example how to#

These tips offer practical ways to stick to your budget while still catering to both your needs and wants.Wondering how to make a household budget that works for your family? Your household budget depends on your income, but sticking to that budget can be an entirely different matter. There are many budgeting apps that allow you to keep track of your expenses so that you see where your money is going. Track your expenses- Even the smallest purchases can create a dent in your budget when it accumulates. Use your bank app to pay for utilities- Most banking apps have a feature where you can automatically deduct the cost of your monthly bill payments from your bank account or credit card. Not only does this save you money, but it also reduces your food waste and helps your family eat healthier. By planning your meals for the next week or two, you only spend on what you need when you go grocery shopping. Rather than eating out frequently (which is more expensive), create a meal plan for your household. Instead of immediately signing up for a loan, wait 24 hours to allow yourself time to think if you can afford the monthly loan payments on top of your monthly expenses.Ĭreate a meal plan for your family- Food is almost always the biggest chunk in a household’s budget, and for good reason. For example, you want to take out a car loan to buy an SUV for your growing family. This isn’t just limited to small wants like designer clothes and branded bags. Use the 24-hour rule- Another tip when it comes to large expenses is to wait 24 hours and see if you need to make that purchase. Failure to pay your loans and balances may eat up into your monthly budget through interests and penalty charges. Never spend more than you have- This means avoiding unnecessary loans and excessive purchases if you are unable to pay them back. You can switch the 20 and 30 percent between your wants and savings, depending on how much you want to save.

utility bills, rent, groceries, transportation costs), 30% on your wants (dining out, streaming services, clothing), and 20% on savings. According to the 50-30-20 guide, 50% of your net income should be spent on your needs (e.g. Use the 50-30-20 budget rule- This is more of a recommended method than a hard rule when it comes to budgeting. Budgeting tips to balance your money wisely

With that in mind, here are a few tips to create a practical budget that you can stick with. Keeping a realistic budget for your household is critical.

While a higher household income provides you more luxuries and room for flexibility, it’s important to keep a budget to address all your needs, set aside savings, and allot money for your wants. If your household is at least earning that much, then you are living above the poverty line and can afford the bare necessities.įor those with a higher cumulative household income, your household budget depends on your income. This exempts them from paying taxes under the new TRAIN law. If we’re following NEDA’s recommendation, a household of five members should have at least PHP 42,000 in income–specifically, two family members earning PHP 21,000 every month. How much should your household budget be? Here are important things you should know. These conversations put a spotlight over families without a wide berth for disposable income and the ways they can keep to their budget. This led to discussions about how much a Filipino family truly needs to survive. They later showed that a family of five needed at least PHP 42,000 to live above the poverty line. NEDA later clarified that the breakdown was a hypothetical budget they presented, not the amount a Filipino family needed to survive. The National Economic and Development Authority (NEDA) once gained online backlash when they supposedly said that an average family of five members need at least PHP 10,000 to live decently.

0 kommentar(er)

0 kommentar(er)